Convenient and secure

Between accounts or between friends, move your money with confidence.

Download our app

Money where you need it, when you want it

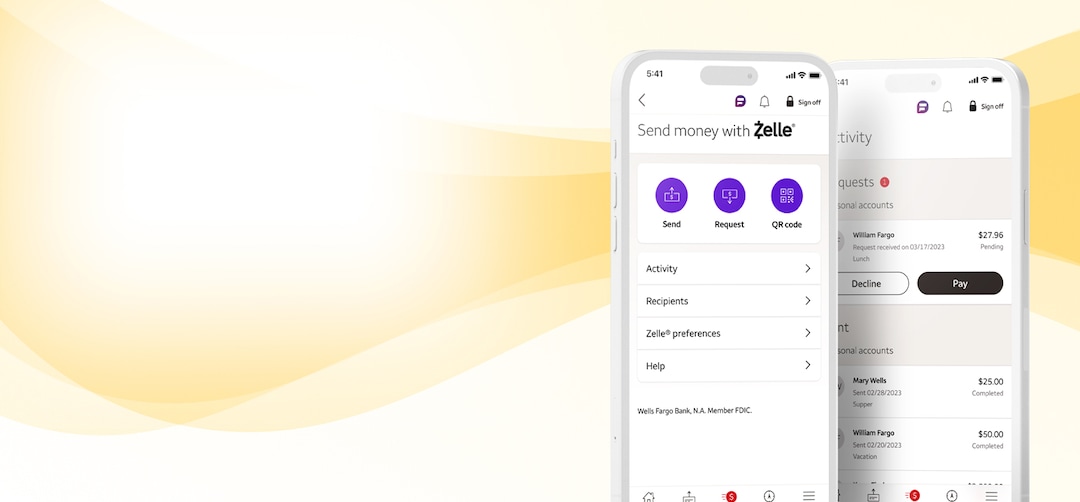

Use Zelle® to send and request money

- Safely and easily send and receive money with trusted friends and family who have U.S. bank accounts

- Send money fast — within minutes

Get the details >

Transfer money between accounts

- Move money between Wells Fargo accounts

- Transfer funds to and from other U.S. financial institutions

Get the details >

Pay your bills online

- Use Bill Pay for sending payments within the U.S.

- Set up a one-time payment or schedule recurring payments

Get the details >

Use your digital wallet

- Use your mobile device to make quick and contactless payments on the go

- Access Wells Fargo ATMs with your digital wallet — no card needed

Get the details >

Securely wire money to businesses and individuals

- Use wire transfers to send money within the U.S. and abroad

- Send funds in foreign currencies or U.S. dollars

Get the details >

Send money to friends and family abroad

- Use ExpressSend® to send money to people in 12 countries

- Transfer money for cash pick-up or for credit to an account

Get the details >

Zelle®

Get money from a friend when you’re splitting the cost of the bill. Pay your pet sitter when you get back from vacation.

Zelle® is a fast, easy way to send and receive money in our app.

Learn more about Zelle®

Mobile and online banking when you need them

Manage your money on the Wells Fargo Mobile® app when you’re on the go. And use Wells Fargo Online® when it’s more convenient to be on your computer.

Enroll now

Get more info

- Set language preferences

- Supported browsers

- Technical requirements

- Online Access Agreement

How was your experience? Give us feedback.

Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Terms and conditions apply. U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. Neither Wells Fargo nor Zelle® offers purchase protection for payments made with Zelle® - for example, if you do not receive the item you paid for or the item is not as described or as you expected. Payment requests to persons not already enrolled with Zelle® must be sent to an email address. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution’s online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Your mobile carrier's message and data rates may apply. Account fees (e.g., monthly service, overdraft) may apply to Wells Fargo account(s) with which you use Zelle®.

Terms and conditions apply. Setup is required for transfers to other U.S. financial institutions, and verification may take 1–3 business days. Customers should refer to their other U.S. financial institutions for information about any potential fees charged by those institutions. Mobile carrier’s message and data rates may apply. See Wells Fargo’s Online Access Agreement for more information.

Digital wallet access is available at Wells Fargo ATMs for Wells Fargo Debit Cards in Wells Fargo-supported digital wallets. Availability may be affected by your mobile carrier’s coverage area. Your mobile carrier’s message and data rates may apply. Some ATMs within secure locations may require a physical card for entry.

Terms and conditions apply. Some (but not all) digital wallets require your device to be NFC (Near Field Communication) enabled and to have the separate wallet app available. Your mobile carrier’s message and data rates may apply.

In addition to any applicable fees, Wells Fargo makes money when we convert one currency to another currency for you. The exchange rate used is set by Wells Fargo, includes a markup and may be different than exchange rates you see elsewhere. For additional information related to Wires and foreign currency wires, please see the Online Access Agreement or applicable service documentation.

Enrollment in Wells Fargo Online® Wires is subject to eligibility requirements, and terms and conditions apply. Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account. Your mobile carrier’s message and data rates may apply. For more information, see the Wells Fargo Online Access Agreement and your applicable account fee disclosures for other terms, conditions, and limitations.

The credit to account or the cash pick-up delivery methods for remittances may not be available at all Remittance Network Members or locations. When sending money to an account, we will need the beneficiary’s qualifying deposit account number at the Remittance Network Member. When sending money for cash pick up, the beneficiary's name provided by the sender must exactly match the beneficiary's name on their government issued identification.

Screen images are simulated. Features, functionality, and specifications appearing in those images may change without notice.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Wells Fargo Bank, N.A. Member FDIC.

QSR-0523-00963

LRC-0423